Updated August 2025

The Company aims to achieve carbon neutrality by 2050 for CO 2 emissions from its own corporate activities (Scope 1 and 2) that can be directly reduced. To this end, we will work to reduce the environmental impact of our fuel and raw materials and production processes, and promote energy conservation and the use of renewable energy. In order to promote decarbonization, there are limits to what can be done by individual companies. Therefore, in addition to our own efforts, we will actively seek to collaborate with groups of companies in the surrounding area and local governments to develop social infrastructure.

| Item | Scope | Unit | 2021年度 | 2022年度 | 2023年度 | 2024年度 | FY2025 Targets |

2030 Targets |

||

|---|---|---|---|---|---|---|---|---|---|---|

| Scope 1 (Emissions) | Consolidated | t-CO 2 /year | 162.0 | 155.9 | 139.3 | 137.4 | 110.0 | 78 | ||

| Scope 2 (Emissions) | Consolidated | t-CO 2 /year | 52.6 | 47.6 | 35.9 | 39.8 | 26.3 | 20 | ||

| Scope 1+2 (Emissions) | Medium- to long-term targets for reduction of greenhouse gas emissions | Consolidated | t-CO 2 /year | 214.6 | 203.5 | 175.2 | 177.2 | 136.3 | 98 | |

| Actual results compared to fiscal 2013 (Scope 1+2) | Consolidated | % | 87% | 82% | 71% | 72% | 55% | 40% | ||

Medium- to long-term targets for reduction of greenhouse gas emissions

In the future, we will continue to work on reducing Scope 3 emissions through cooperation with upstream and downstream partners and the development and provision of environmentally conscious products and technologies for reducing environmental footprint based on our unique technologies.

Current Status of Greenhouse Gas Emissions throughout the Value Chain (Scope 3/FY2024)

| Category | 2022年度 | 2023年度 | 2024年度 | ||||

|---|---|---|---|---|---|---|---|

| Emissions (t-CO2 /year) |

Percentage (%) |

Emissions (t-CO2 /year) |

Percentage (%) |

Emissions (t-CO2 /year) |

Percentage (%) |

||

| C1 | Purchased Goods and Services | 846,856 | 53.2% | 779,585 | 55.1% | 873,385 | 55.1% |

| C2 | Capital goods | 116,783 | 7.3% | 66,623 | 4.7% | 134,950 | 8.5% |

| C3 | Energy-related activities not included in Scope 1 and 2 | 128,465 | 8.1% | 109,607 | 7.7% | 116,373 | 7.3% |

| C4 | Upstream transportation and distribution | 131,555 | 8.3% | 110,136 | 7.8% | 112,214 | 7.1% |

| C5 | Waste generated through business activities | 18,398 | 1.2% | 17,989 | 1.3% | 13,665 | 0.9% |

| C6 | Business trips | 546 | 0.0% | 563 | 0.0% | 568 | 0.0% |

| C7 | Employee commuting | 1,705 | 0.1% | 1,760 | 0.1% | 1,770 | 0.1% |

| C8 | Upstream leased assets | - | 0.0% | - | 0.0% | - | - |

| C9 | Downstream Transportation and distribution | 0 | 0.0% | 0 | 0.0% | 756 | 0.0% |

| C10 | Processing of sold products | - | 0.0% | - | 0.0% | - | - |

| C11 | Use of sold products | - | 0.0% | 0 | 0.0% | - | - |

| C12 | End of life treatment of sold products | 347,466 | 21.8% | 328,816 | 23.2% | 331,087 | 20.9% |

| C13 | Downstream Leased assets | - | 0.0% | - | 0.0% | - | - |

| C14 | Franchises | - | 0.0% | - | 0.0% | - | - |

| C15 | Investments | - | 0.0% | - | 0.0% | - | - |

| Total | 1,591,774 | 100% | 1,415,079 | 100% | 1,584,767 | 100% | |

Our company continues its efforts toward achieving zero emissions ※ by utilizing industrial waste as a substitute for raw materials and thermal energy in cement kilns and reducing waste emissions through various production process improvements.

Amid growing attention to ESG investment that emphasizes corporate social responsibility, the importance of environmental information disclosure is increasing. The Denka Group is actively working on information disclosure regarding environmental burden reduction measures through financial reports and public disclosure to external frameworks.

Since 2015, the Denka Group has been responding to CDP's Climate Change Questionnaire to enhance environmental management aimed at promoting the sustainable use of resources and energy and increasing corporate value. From 2019, we have also expanded our response to include Water Security. Furthermore, we are objectively analyzing our responses to CDP, and conducting governance related to environmental management and examining and improving risks and opportunities based on future insights considering climate change.

In 2024, we obtained the scores of B for Climate Change and A for Water Security.

The latest CDP questionnaire is here

Our company is implementing the following initiatives to fulfill our responsibilities as the administrator of the target devices ※1.

In addition, JRECO conducts an annual rating of companies regarding their understanding and awareness of the Act on Regulation, Efforts, and Information Disclosure of Fluorocarbons, and information dissemination. Our company has received the highest rating of A rank for three consecutive years.

In the future, we will continue to implement appropriate inspections and early leak prevention measures, and promote efforts to prevent global warming as well as ensure compliance with laws and regulations.

| Item | Unit | 2020年度 | 2021年度 | 2022年度 | 2023年度 | 2024年度 |

|---|---|---|---|---|---|---|

| Calculation of CFC emissions leak ※3 | t-CO2 | 572 | 790 | 771 | 5,190 | 303 |

In order to improve the reliability and transparency of the data of our greenhouse gas emissions, and to promote ongoing environmental management, we have received verification from an independent third party (Japan Quality Assurance Organization: JQA).

For details, please refer to the reports posted on our website.

Japan: April 1, 2023 – March 31, 2024

Overseas: January 1, 2023 – December 31, 2023

Scope 1 and 2 covers CO 2 emissions from energy and non-energy sources during the period from April 2023 to March 31, 2024, at 10 plants in Japan.

Scope 3 (Categories 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15) covers emissions during the period from April 2023 to March 31, 2024. However, the targets for each category are based on our calculation rules.

Consideration for the Global EnvironmentDenka is committed to global environmental preservation based on Responsible Care, an initiative promoted by the global chemical industry. As a responsible chemical manufacturer, Denka will continue to address the issues of global environmental preservation.

2050 Roadmap Efforts to Reduce Environmental Impact Efforts for Environmentally Conscious Products Environmental Accounting

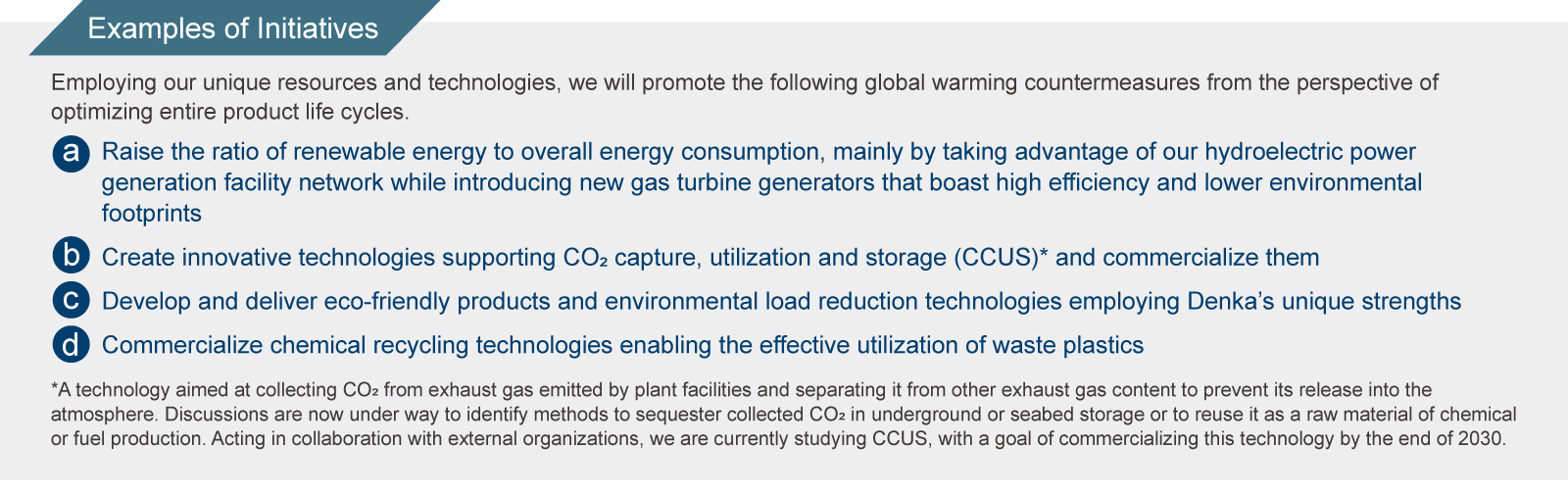

Denka Group is committed to achieving its target of "net zero CO2 emissions" by 2050. To this end, we have set the interim target of reducing CO2 emissions by 60% from the fiscal year 2013 level by 2030.

Denka accurately understands the environmental burden substances emitted from the production facilities of Group companies and is working on their continuous reduction. The substances targeted include greenhouse gases such as CO2...

Greenhouse gas emissions Zero emissions initiatives Information disclosure initiatives Fluorocarbons...

Addressing Risks and OpportunitiesRegarding the risks and opportunities posed by climate change, we will conduct scenario analysis based on the following two temperature rise scenarios: 1.5°C or less (Glasgow Climate Pact) and 4°C (business-as-usual).

Expansion of renewable energy and introduction of environmentally friendly power generation technologies Certification of special measures for levies based on the Renewable Energy Special Measures Act ...

hydroelectric power plant (Map) *As of August 2025 / Including our joint venture company's power plant. Private power plant and maximum output (20...

Use of environmental energy-related subsidies In our efforts to reduce environmental impact and promote energy conservation, we actively utilize subsidy programs from the Ministry of Economy, Trade and Industry and the Ministry of the Environment, etc.

Our Approach to Biodiversity Initiatives for Biodiversity Participation in TNFD Forum ...

Issues of the Company Group Specific Initiatives Water Resource Data Water Risk Assessment ...

Approach to resource recycling (circular economy) Chemical recycling ISCC PLUS certification ...

Environmental conservation costs Environmental conservation effect Economic effect Environmental conservation costs ...

Data Scope: Total of 8 locations of Denka head office (80% of Denka product sales manufactured) *Final disposal amount (landfill treatment) for FY2024...

Greenhouse gas emissions Renewable energy Main environmental impact (Head office and domestic group companies) Water resources Envi...

2024 Fiscal Year Main Substances Emitted and Water Used Ratios Head Office, Branch Offices Omi Plant Chiba Plant ...